Tata Technologies Share Price: An In-Depth Analysis and Future Outlook

Tata Technologies is a global engineering and product development digital services company that caters to the automotive, aerospace, industrial machinery, and industrial sectors. As a key player in the technology and engineering services industry, its share price is of significant interest to investors and market analysts. This blog post provides a detailed analysis of Tata Technologies’ share price, historical trends, factors influencing its price, and future outlook.

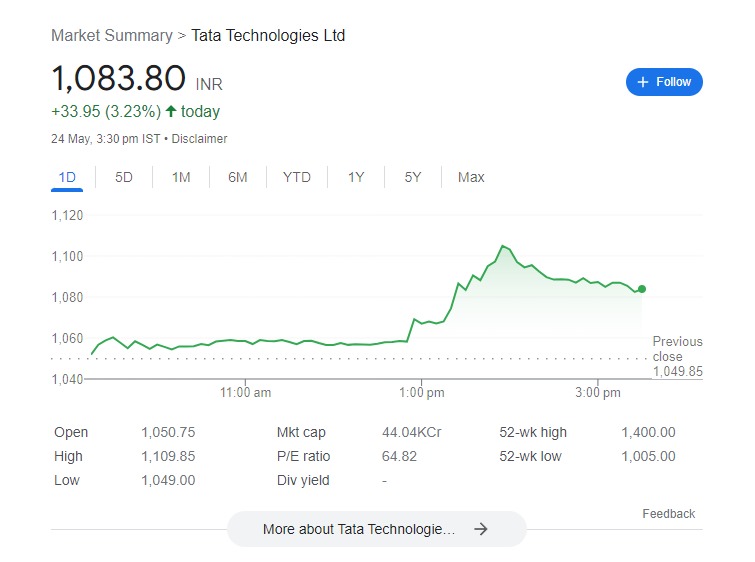

Tata technologies Share Price Trends

Understanding the historical trends of Tata Technologies’ share price can provide valuable insights into its performance and help predict future movements. Over the years, Tata Technologies has experienced various fluctuations due to market conditions, company performance, and external factors.

Key Milestones

Initial Public Offering (IPO): Tata Technologies’ IPO was a significant event that set the stage for its entry into the stock market. The initial share price was influenced by investor sentiment and market conditions at the time.

Major Contracts and Partnerships: Strategic partnerships and major contracts have historically impacted the share price positively, reflecting the company’s growth and expansion.

Market Trends: Global market trends, such as the rise of electric vehicles and advancements in digital technologies, have also played a role in shaping the share price.

Factors Influencing Tata Technologies’ Share Price

Several factors can influence the share price of Tata Technologies. These include internal factors, such as company performance and strategic initiatives, and external factors, such as market conditions and economic trends.

Internal Factors

Financial Performance: Quarterly and annual financial results, including revenue, profit margins, and earnings per share, significantly impact the share price.

Innovation and R&D: Investment in research and development, innovation in products and services, and technological advancements can drive the share price upward.

Management Decisions: Strategic decisions made by the company’s management, including mergers, acquisitions, and divestitures, can influence investor confidence and share price.

External Factors

Market Conditions: Overall market conditions, including economic growth, inflation rates, and interest rates, affect investor sentiment and share prices.

Industry Trends: Trends within the technology and engineering services industry, such as the adoption of new technologies and changes in regulatory policies, can impact the share price.

Global Events: Geopolitical events, trade policies, and global economic conditions also play a role in determining the share price.

Tata technologies share price : stock value

Investing in the stock market requires a deep understanding of the factors that influence stock prices. Tata Technologies, a leading global engineering and product development digital services company, has been a subject of interest for many investors. This article delves into the factors affecting Tata Technologies’ stock value, analyzes its market performance, and provides insights into its future prospects.

Introduction to Tata Technologies

Tata Technologies is a part of the Tata Group, one of India’s largest and most respected conglomerates. Specializing in product lifecycle management (PLM), engineering services, and digital transformation, Tata Technologies serves various industries, including automotive, aerospace, industrial machinery, and more. The company’s innovative solutions and strong industry presence make it a valuable asset within the Tata Group.

Key Factors Influencing Tata Technologies’ Stock Value

Market Demand for Engineering Services:

The demand for engineering services plays a significant role in the company’s stock value. As industries evolve and adopt new technologies, the need for advanced engineering solutions increases, positively impacting Tata Technologies’ market performance.

Economic Conditions:

The overall economic environment influences the stock market. Economic growth, inflation rates, and interest rates affect investor sentiment and stock prices. A stable economy generally leads to a positive outlook for Tata Technologies’ stock.

Technological Advancements:

Tata Technologies’ commitment to innovation and technological advancements positions it as a leader in the industry. The company’s ability to adapt to new technologies and provide cutting-edge solutions enhances its competitiveness and stock value.

Company Financial Performance:

Strong financial performance, reflected in revenue growth, profitability, and healthy balance sheets, is crucial for maintaining investor confidence. Tata Technologies’ consistent financial growth contributes to its stock value stability.

Global Market Trends:

The company’s presence in international markets means that global trends and geopolitical events can impact its stock value. Trade policies, international relations, and market dynamics in regions where Tata Technologies operates are significant factors.

Strategic Partnerships and Acquisitions:

Partnerships and acquisitions can significantly influence a company’s stock value. Tata Technologies’ strategic collaborations with other industry leaders and its acquisition of complementary businesses enhance its market position and investor appeal.

Tata technologies market price

Introduction

Tata Technologies, a global engineering and product development digital services company, has been making waves in the market with its innovative solutions and strategic partnerships. Understanding the market price of Tata Technologies involves examining various factors, including market trends, financial performance, and industry developments. This comprehensive analysis aims to provide insights into Tata Technologies’ market price and what investors and stakeholders can expect in the future.

What is Tata Technologies?

Tata Technologies is a subsidiary of Tata Motors and a part of the larger Tata Group. The company specializes in providing engineering services, product lifecycle management (PLM) solutions, and IT services to various industries, including automotive, aerospace, and industrial machinery. With a strong global presence and a reputation for innovation, Tata Technologies plays a crucial role in driving digital transformation across industries.

Market Price Analysis

Historical Market Price Trends

Understanding the historical market price trends of Tata Technologies is essential for predicting future movements. Over the past few years, Tata Technologies has shown consistent growth, driven by its strategic initiatives and expanding client base. The company’s market price has been influenced by several key factors, including its financial performance, industry trends, and macroeconomic conditions.

Factors Influencing Market Price

Financial Performance: Tata Technologies’ financial health, including revenue growth, profit margins, and cash flow, significantly impacts its market price. Strong quarterly results and positive financial outlooks tend to boost investor confidence and drive up the market price.

Industry Trends: As a provider of engineering and IT services, Tata Technologies is closely tied to the performance of the industries it serves. Trends in the automotive, aerospace, and manufacturing sectors directly affect the company’s market price.

Innovation and R&D: Tata Technologies’ commitment to innovation and research and development (R&D) also plays a crucial role. Investments in new technologies and solutions can enhance the company’s competitive edge and positively influence its market price.

Strategic Partnerships and Acquisitions: Collaborations with other industry leaders and strategic acquisitions can strengthen Tata Technologies’ market position and drive its market price higher.

Global Economic Conditions: Broader economic conditions, including inflation rates, interest rates, and geopolitical factors, can impact Tata Technologies’ market price. Economic stability tends to foster market confidence, while uncertainty can lead to price volatility.

Future Predictions

Growth Opportunities

Tata Technologies is well-positioned to capitalize on several growth opportunities in the coming years. The increasing demand for digital transformation solutions across industries presents a significant market potential. Additionally, the company’s focus on sustainable engineering and smart manufacturing aligns with global trends, offering further growth prospects.

Potential Challenges

Despite the positive outlook, Tata Technologies may face challenges such as intense competition, technological disruptions, and regulatory changes. Staying ahead of these challenges will be crucial for maintaining a favorable market price.

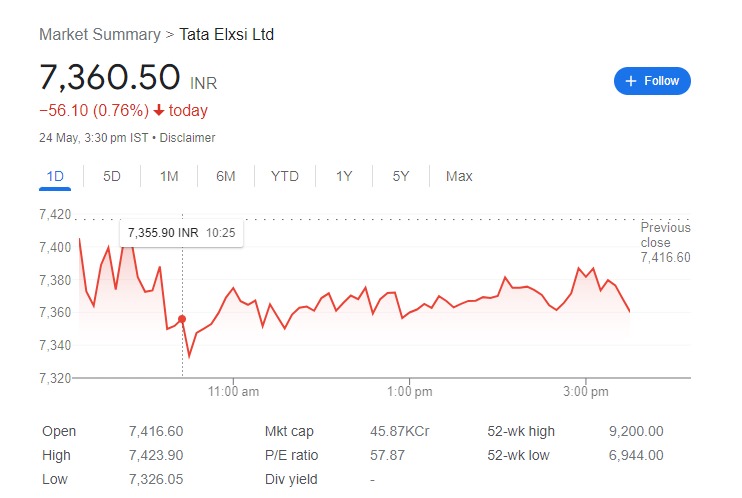

Tata elxsi Share price

Introduction to Tata Elxsi

Company Overview

Tata Elxsi is a renowned global design and technology services company, providing a range of services in the fields of automotive, broadcast, communications, and healthcare. As a part of the prestigious Tata Group, Tata Elxsi leverages its innovative prowess to deliver cutting-edge solutions that enhance customer experiences and drive business growth.

Historical Background

Founded in 1989, Tata Elxsi has evolved significantly over the years. Initially focused on providing design services, the company has expanded its portfolio to include technology and engineering services. This evolution has positioned Tata Elxsi as a critical player in the global technology landscape.

Core Services and Offerings

Tata Elxsi’s core services encompass product design and engineering, systems integration, and software development. The company is particularly noted for its expertise in the automotive industry, where it provides advanced solutions for autonomous driving, connected vehicles, and electric vehicles.

Market Position

With a strong presence in multiple geographies and a robust client base, Tata Elxsi holds a formidable position in the market. Its strategic alliances and continuous innovation have contributed to sustained growth and a solid reputation among industry peers.

Understanding Share Prices

Definition and Importance

Share prices represent the market value of a company’s equity. They are crucial indicators of a company’s financial health and investor confidence. Share prices impact the company’s ability to raise capital and influence investor decisions.

How Share Prices are Determined

Share prices are determined by various factors, including company performance, market conditions, and investor sentiment. The interplay of supply and demand in the stock market also plays a critical role in setting share prices.

Factors Affecting Share Prices

Several factors affect share prices, such as economic indicators, industry trends, company earnings, and geopolitical events. Understanding these factors helps investors make informed decisions.

Tata Elxsi’s Share Price History

Historical Share Price Data

A detailed examination of Tata Elxsi’s historical share price data reveals trends and patterns that are vital for investors. Analyzing past performance helps predict future movements and identify investment opportunities.

Major Milestones and Fluctuations

Tata Elxsi has experienced several significant milestones and fluctuations in its share price. Key events, such as major product launches, strategic partnerships, and market expansions, have influenced these changes.

Comparative Analysis with Industry Peers

Comparing Tata Elxsi’s share price performance with its industry peers provides a comprehensive view of its market position. This analysis highlights Tata Elxsi’s strengths and areas for improvement.

Financial Performance of Tata Elxsi

Revenue and Profit Trends

Tata Elxsi’s revenue and profit trends are critical indicators of its financial health. Consistent growth in these areas reflects the company’s ability to generate value for its shareholders.

Key Financial Ratios

Financial ratios, such as the current ratio, quick ratio, and debt-to-equity ratio, provide insights into Tata Elxsi’s financial stability and operational efficiency.

Quarterly and Annual Reports Analysis

Analyzing Tata Elxsi’s quarterly and annual reports offers a detailed understanding of its financial performance. These reports highlight key achievements, challenges, and strategic initiatives