Adani Share price In BSE100, there were five additions and deletions, respectively. Page Industries Ltd, SBI Cards and Payment Services Ltd, ICICI Prudential Life Insurance Company Ltd, Jubilant Food Works Ltd and Zee Entertainment Enterprises Ltd will be dropped and REC Ltd, HDFC Asset Management Company Ltd, Canara Bank, Cummins India Ltd and Punjab National Bank will be added, BSE stated.

Adani Ports share price: Around 1.88 crore shares were last seen changing hands, valued at $ 2,630.73 crore. Market capitalisation (m-cap) came at Rs 3,05,810.87 crore. The official buyers and sellers of the block deals are not yet known.

Adani Wilmar Share Price

Comprehensive Analysis of Adani Wilmar Share Price and Market Position

Overview of Adani Wilmar Limited

Adani Wilmar Limited (AWL), a joint venture between the Adani Group and Wilmar International Limited, is a leading player in the edible oil and food products sector in India. Established in 1999, AWL has grown to become a significant entity in the FMCG industry, offering a diverse range of products under the brand name “Fortune.” Financial Performance and Stock Analysis Recent Share Price Trends.The share price of Adani Wilmar has shown considerable movement over recent months, reflecting both market conditions and company performance. Investors have been keenly observing the fluctuations as indicators of the company’s financial health and market strategy effectiveness.

Market Position and Competitive Landscape of adani share price

SWOT Analysis

Strengths:

- Strong brand recognition with “Fortune.”

- Extensive distribution network.

- Robust financial performance.

Weaknesses:

- High dependency on raw material prices.

- Intense competition in the FMCG sector.

Opportunities:

- Expansion into new product categories.

- Growth in rural markets.

- Increasing demand for healthy and organic products.

Threats:

- Volatile commodity prices.

- Regulatory changes.

- Economic downturns.

Competitor Comparison

Adani Wilmar faces competition from several major players in the FMCG sector, including ITC, HUL, and Nestlé. Despite the competitive landscape, AWL’s strategic initiatives and strong market presence give it a competitive edge.

https://www.moneycontrol.com/india/stockpricequote/consumer-food/adaniwilmar/AW

Adani share price of Green

Adani Green Energy Limited (AGEL) is a leading renewable energy company in India, part of the diversified Adani Group. AGEL focuses on the development, construction, and operation of utility-scale grid-connected solar and wind farm projects.

Importance of Analyzing Share Prices

Understanding the share price movements of AGEL is crucial for investors, analysts, and stakeholders. It provides insights into the company’s financial health, market performance, and future growth potential.

Key Milestones

- 2015: Establishment of AGEL

- 2018: Successful Initial Public Offering (IPO)

- 2020: Inclusion in the NIFTY Next 50 index

- 2022: Achievement of 20 GW renewable energy capacity

Current Market Position

Stock Exchange Listings

AGEL is listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE), trading under the ticker symbol ADANIGREEN.

Recent Share Price Performance

A detailed analysis of AGEL’s share price performance over the past year, highlighting significant highs, lows, and trends.

Financial Overview

Revenue and Profit Analysis

- Revenue Growth: AGEL has shown consistent revenue growth, driven by its expanding renewable energy capacity.

- Profit Margins: Examination of the company’s profit margins over the past five years.

Key Financial Ratios

- Price-to-Earnings (P/E) Ratio

- Debt-to-Equity Ratio

- Return on Equity (ROE)

Investment Analysis

SWOT Analysis

- Strengths: Market leadership, strong backing from Adani Group, robust project pipeline.

- Weaknesses: High debt levels, regulatory risks.

- Opportunities: Expansion into new markets, technological advancements in renewable energy.

- Threats: Market competition, political instability.

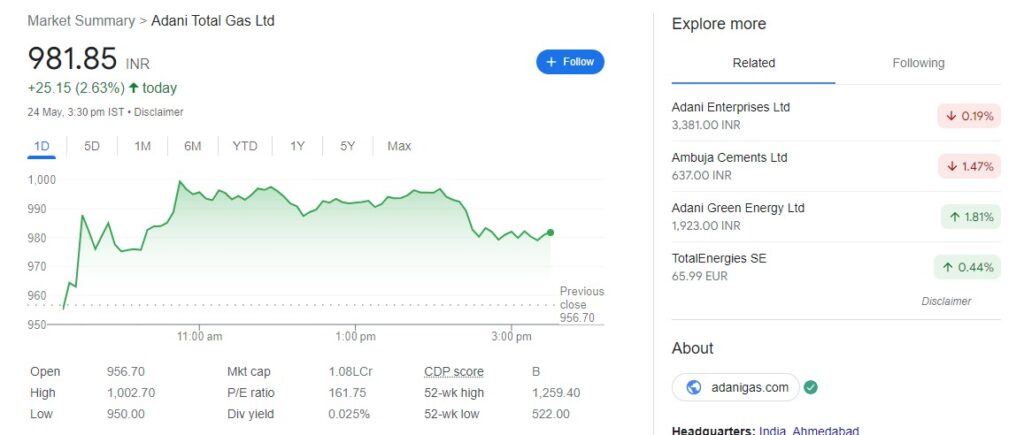

Adani share price of Gas

Introduction

Adani Gas is a key player in the Indian energy sector, focusing on the distribution of natural gas. Monitoring its share price is crucial for investors looking to capitalize on market movements and trends. This comprehensive analysis will delve into various aspects of Adani Gas’s share price, from historical performance to investment strategies.

Overview of Adani Gas

Adani Gas Limited, part of the Adani Group, operates in the natural gas distribution sector in India. Established with the vision of creating a sustainable energy future, Adani Gas supplies compressed natural gas (CNG) to the transportation sector and piped natural gas (PNG) to industrial, commercial, and residential consumers.

Industry experts and financial analysts provide valuable insights and forecasts regarding Adani Gas’s future performance, helping investors make informed decisions.

Risk Assessment

Market Risks

Market risks include economic downturns, regulatory changes, and geopolitical events that can affect the overall market and Adani Gas’s share price.

Company-specific Risks

Risks specific to Adani Gas include operational challenges, competition, and management decisions that can impact its performance.

Expert Insights

Industry experts and financial analysts provide valuable insights and forecasts regarding Adani Gas’s future performance, helping investors make informed decisions.

See My other posts

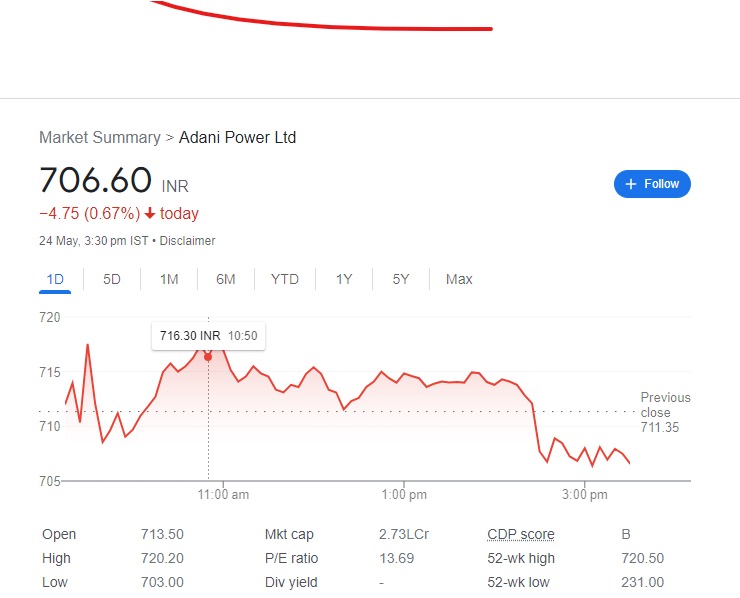

Adani power share price

Introduction

The share price of Adani Power, a significant player in India’s energy sector, has garnered considerable attention from investors and analysts alike. Understanding the dynamics behind its fluctuations, historical performance, and future prospects is essential for making informed investment decisions. This article delves into a detailed analysis of Adani Power’s share price, covering various aspects from technical specifications to expert insights.

Technical Specifications

Overview of Adani Power

Company Background: Founded in 1996, Adani Power is a subsidiary of the Adani Group, focusing on power generation and transmission.

Installed Capacity: As of the latest data, Adani Power has an installed capacity of over 12,450 MW.

Power Plants: The company operates thermal power plants across India, including in states like Gujarat, Maharashtra, Karnataka, Rajasthan, and Chhattisgarh.

Stock Market Presence

Stock Exchange Listings: Adani Power is listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) of India.

Ticker Symbol: The ticker symbol for Adani Power is ADANIPOWER on both BSE and NSE.

Applications

Role in Energy Sector

Electricity Generation: Adani Power is one of India’s largest private thermal power producers, contributing significantly to the national grid.

Renewable Energy Initiatives: In addition to thermal power, the company is expanding its portfolio to include renewable energy projects.

Industrial and Commercial Use

Energy Supply: Adani Power supplies electricity to various industries and commercial establishments, ensuring reliable power for economic activities.

Grid Stability: The company’s power plants play a crucial role in maintaining grid stability across different regions.

Benefits

Financial Performance

Revenue Growth: Adani Power has demonstrated consistent revenue growth, driven by increased power generation and favorable tariffs.

Profit Margins: The company has optimized its operations to maintain healthy profit margins despite fluctuations in fuel costs.

Economic Impact

Job Creation: Adani Power’s projects have created numerous job opportunities in construction, operation, and maintenance of power plants.

Infrastructure Development: Investments in power infrastructure have spurred regional development and improved living standards.

Amazing content