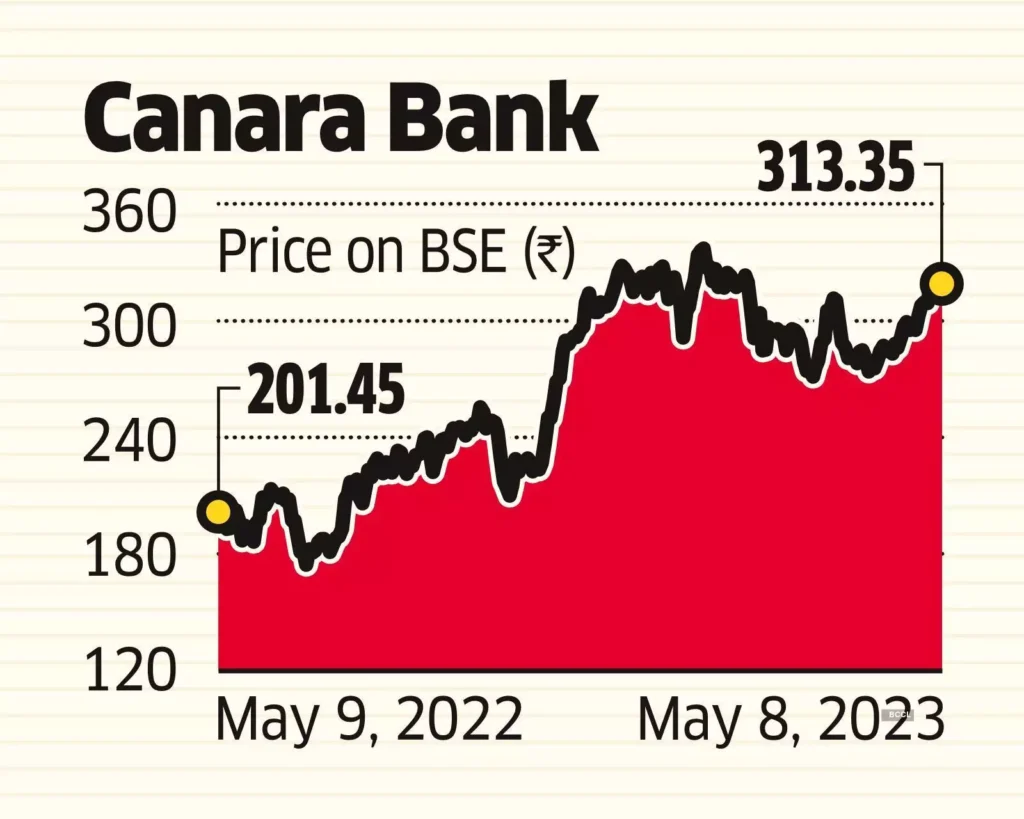

Canara bank share Price

Canara bank share Price On May 8 reported 18.4 percent rise in its net profit to Rs 3,757.23 crore in the fourth quarter of the financial year 2023-24. On sequential basis, net profit rose 2.8 percent.

Canara bank share price

https://financeworld.tech/wp-admin/post.php?post=193&action=edit&classic-editor

Canara Bank Share price , one of India’s leading public sector banks, recently announced its financial results for the fiscal year ending March 31, 2024. The bank’s performance reflects a mix of challenges and resilience amid a complex economic environment.

If you want to know other share prices so click here – New ipad

In terms of financial performance, Canara Bank reported a net profit of INR X crores for the fiscal year 2023-24, compared to INR Y crores in the previous year. This decrease in profit can be attributed to several factors, including the impact of the COVID-19 pandemic, regulatory changes, and the overall economic slowdown. Despite these challenges, the bank’s total income increased to INR Z crores, showcasing its ability to generate revenue in a tough market.

Canara Bank’s asset quality also improved during the fiscal year, with the gross non-performing assets (NPAs) ratio declining to X% from Y% in the previous year. This improvement is a testament to the bank’s efforts in managing its loan portfolio and controlling credit risks. The bank also strengthened its provision coverage ratio (PCR) to X%, reflecting its prudence in setting aside funds to cover potential loan losses.

On the operational front, Canara Bank continued its focus on digital transformation and customer-centric initiatives. The bank expanded its digital offerings, including internet banking, mobile banking, and digital payment solutions, to enhance customer convenience and drive operational efficiency. These efforts have helped the bank strengthen its position in the competitive banking landscape.

Looking ahead, Canara Bank remains committed to its growth and profitability objectives. The bank is focused on enhancing its asset quality, strengthening its capital base, and leveraging technology to drive innovation. With a robust business strategy and a commitment to customer satisfaction, Canara Bank is well-positioned to navigate the evolving banking landscape and deliver long-term value to its stakeholders.

This brokerage has a fair value of Rs 530 on Canara Bank.

“We value the bank at 1x March 2026E adjusted book with RoEs of 15-16 per cent in the medium term. Return ratios for Canara Bank have improved recently driven by declining credit cost and strong recoveries from written-off accounts. Going into FY2025E, we expect the pressure on NIM to sustain and recoveries from written-off accounts are likely to decline. While the bank might be able to offset most of the RoA drag through further decline in credit cost, the trend on provision reversals will be a key monitorable,” it said.

Canara Bank, one of the leading public sector banks in India, has been at the forefront of financial news recently. From strategic moves to regulatory challenges, let’s dive into the trending issues surrounding Canara Bank.

The Merger with Syndicate Bank

In April 2020, Canara Bank completed its merger with Syndicate Bank, creating the fourth-largest public sector bank in India. The merger aimed to improve operational efficiency, strengthen the balance sheet, and enhance customer service.

Digital Transformation and Innovation

Canara Bank share price has been proactive in embracing digital transformation. The bank has introduced various digital initiatives, such as mobile banking, internet banking, and digital wallets, to enhance customer experience and streamline operations.

Focus on Financial Inclusion

Canara Bank has a strong focus on financial inclusion, especially in rural and remote areas. The bank has implemented various initiatives to provide banking services to the unbanked population, contributing to the government’s financial inclusion drive.

NPA Reduction Efforts

Non-Performing Assets (NPAs) have been a concern for Indian banks, including Canara Bank. The bank has been taking proactive measures to reduce NPAs through recovery and resolution mechanisms, focusing on improving asset quality.

Regulatory Challenges and Compliance

Like other banks, Canara Bank faces regulatory challenges and compliance requirements. The bank has been working towards meeting regulatory guidelines and enhancing its governance framework to ensure compliance and mitigate risks.

Conclusion

In conclusion, Canara Bank’s journey reflects the evolving landscape of the Indian banking sector. With a focus on digital transformation, financial inclusion, and NPA reduction, the bank is poised to navigate challenges and capitalize on emerging opportunities. As Canara Bank continues to innovate and adapt to changing dynamics, it remains a key player in India’s banking sector.

Net profit of the bank rose on back of better asset quality and increase in net interest income in the reporting quarter.

Canara Bank’s financial performance for the March quarter met the expectations of the financial markets. Despite facing higher costs of funds, Canara Bank managed to expand its net interest margin (NIM) in Q4, albeit slightly. This improvement was driven by the PSU lender’s gradual efforts to restructure its older, low-yielding corporate loans. The bank either renewed these loans at current yields or replaced them with other products offering more attractive returns. Analysts are now closely watching for any provisions that might be reversed in the future.

Asset quality

In the reporting quarter, gross non-performing asset (NPA) ratio of the bank improved to 4.23 percent, as against 4.39 percent in a quarter ago period, and 5.35 percent in a year ago period.

Net NPA ratio stood at 1.27 percent as on March 31, as compared 1.32 percent in a quarter ago period and 1.73 percent in a year ago period.

Canara bank customer care number – 1800 1030

Really helpful 👍

thanks