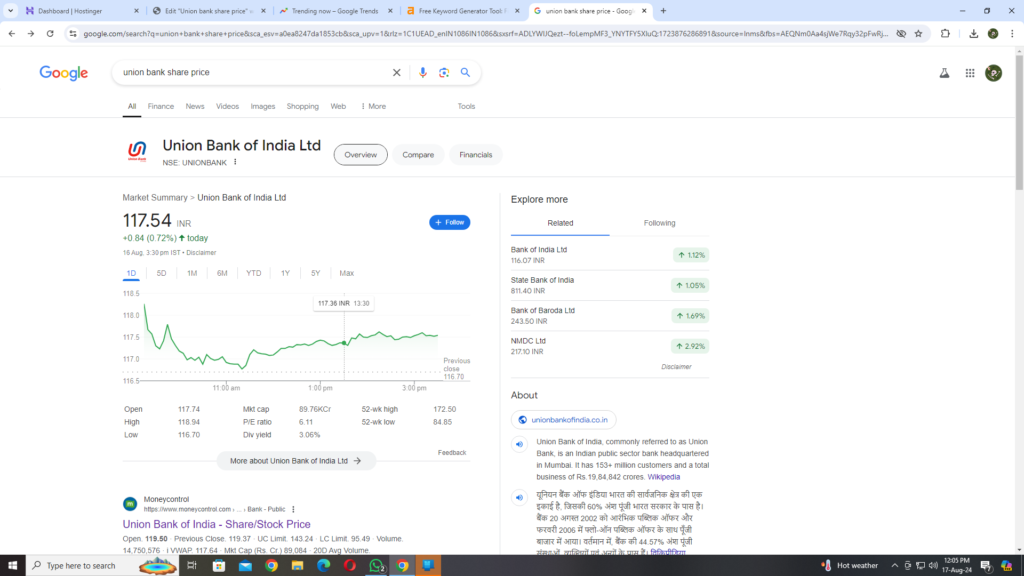

Union Bank share price of India, commonly referred to as Union Bank , is an Indian public sector bank headquartered in Mumbai. It has 153+ million customers and a total business of Rs.19,84,842 crores.[8] After the merging with Corporation Bank and Andhra Bank, which came into effect on 1 April 2020, the merged entity became one of the largest PSU banks in terms of branch network with around 8700+ branches. Four of these are located overseas in Hong Kong, Dubai, Antwerp, and Sydney. UBI also has representative offices at Shanghai, Beijing and Abu Dhabi. UBI operates in the United Kingdom through its wholly owned subsidiary, Union Bank of India (UK). The bank has a network of 8500+ domestic branches, 10000+ ATMs, and 18000+ Business Correspondent Points serving over 153 million customers with 76,700+ employees.

Experience our cutting-edge banking solutions designed to meet your unique needs.

Enjoy personalized customer support from our dedicated team of banking experts.

Union Bank of India was established on 11 November 1919 in Bombay (now Mumbai) by Seth Sitaram Poddar.[1] The bank’s corporate office was inaugurated by Mahatma Gandhi. At the time of India’s independence in 1947, the bank had four branches – three in Mumbai and one in Saurashtra in trade centres.[10] By the time the Indian government nationalized UBI in 1969, it had 240 branches. In 1975, it acquired Belgaum Bank, a private sector bank established in 1930 that had itself merged in a bank in 1964, the Shri Jadeya Shankarling Bank (Bijapur; incorporated on 10 May 1948). In 1985, it acquired Miraj State Bank, which had been established in 1929, and which had 26 branches. In 1999, UBI acquired Sikkim Bank with its eight branches.

UBI expanded internationally in 2007 with the opening of offices in Abu Dhabi, United Arab Emirates and in Shanghai, China.[11] In 2008, it established a branch in Hong Kong.[12] In 2009, Union Bank opened a representative office in Sydney, Australia.[13][citation needed]

On 30 August 2019, Finance Minister Nirmala Sitharaman announced that Andhra Bank and Corporation Bank would be merged into Union Bank of India. The proposed merger would make Union Bank the fifth largest public sector bank in the country with assets of ₹14.59 lakh crore (US$170 billion) and 9,609 branches.[14][15] The Board of Directors of Andhra Bank approved the merger on 13 September.[16][17] The Union Cabinet approved the merger on 4 March, and it was completed on 1 April 2020

Want to know about NHPC share price so click here https://financeworld.tech/nhpc-share-price/